If you are currently a sole trader, freelancing, or work for a larger business seeking more control over your work and the security of working as part of a larger team, (while not solely responsible for them), a co-operative model may be right for you.

A co-operative (co-op) is a business that is democratically owned by its members, to meet their shared needs. The members can be its customers, employees, the local community or a group of businesses with shared interests. They can basically be:

Here’s a video to explain a co-op in more detail. There are over three million cooperatives globally, employing nearly 280 million people and supporting over a billion. They come in all shapes and sizes, the largest such as: Crédit Agricole, a global bank with a $89bn turnover. In the UK they include John Lewis, The Co-operative and Nationwide. For this blog post we’re interested in the much smaller scale: Three to five people starting a business together in the creative and tech sectors. You may be looking to develop websites, provide brand and design services, launch a new phone app or develop a game.

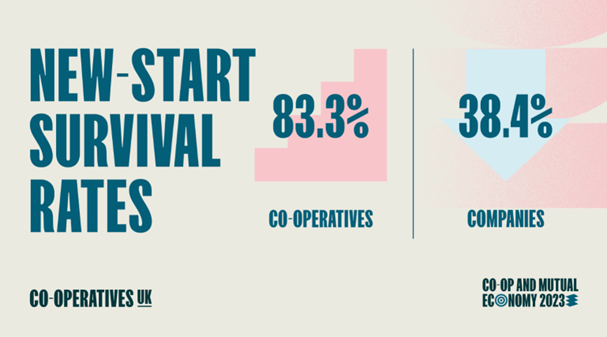

Co-operatives UK, the national trade body, has recently released a report highlighting that co-ops are over twice as likely to survive the early years of trading when compared to other start-up businesses. Setting up a business on your own can be stressful. You may not have all the knowledge, skills or start-up capital to do this on your own. But by working as a small team with others from your profession or sector, you can share the responsibility, risks and rewards. You may not be the next Elon Musk, but you may not want to be either.

There are 100’s of co-ops in the UK operating in the creative and tech sectors, mostly these are worker co-ops. Businesses owned and controlled by a group of self-employed or employed workers. Below are just a few examples: Creative Co-op: A group of four seasoned creative professionals, fed up with working for others, they decided to set-up their own brand and design agency together. Outlandish: Started as a typical tech agency, the founders quickly realised that converting into a worker co-op and sharing ownership with their employees would generate value for everyone. Now a £1m turnover business with eight members. The Developer Society: A not-for-profit digital agency with the express goal of paying decent wages, and delivering social impact, turnover £1.1m, 19 members.

Setting up a co-op is mostly the same as any other business, with a few differences that I have focussed on below:

Determine the specific goals and objectives of your co-op. What problem will it solve or what need will it fulfil? This is the same as any business, the difference, rather than focusing on this as an individual you should approach as a group, to find that sweet spot of:

Finding like-minded individuals who share this vision and are willing to participate in the co-op is key. This group will become your founding members and shareholders. Co-ops operate on a ‘one member one vote’ basis. You will own the business equally, so make sure to set out your expectations at the start and that you're all in it for similar enough reasons. That as a team you can all pull your weight and cover enough of the basics: Someone who can sell, someone you can build, someone who can care about the details (finances etc.).

Creating a business plan is no different, you may spend slightly more time on how you make decisions as a group. Typically, in smaller co-ops all members are directors albeit some taking on specific roles. As they grow, these cop-ops tend to move to a model where members elect a few people to be directors on behalf of the whole membership.

This is probably the area of biggest difference. Worker co-ops tend to operate in less capital-intensive sectors as they cannot raise equity from separate investors. Initial financing will come from founder members or taking on debt. Growth and future investment, tends to come through reinvestment of profits or taking on debt.

Co-operatives can be incorporated with any legal form sometimes as Limited Liability Partnerships, but typically as Companies limited by share or guarantee. For further advice on starting a freelancers’ or workers’ co-op locally in Lancashire contact Preston Co-op Development Network. At a UK wide level you can contact workers.coop About the contributor  John Atherton is a seasoned cooperative business consultant. After working 15 years at Co-operatives UK the national infrastructure organisation, he is currently working with Preston Co-op Development Network. John’s expertise lies in start-ups or conversion to worker co-ops, team dynamics and strategy formation in low hierarchy cultures. Formed in 2017 Preston Cooperative Development (PCDN) promotes and supports the development of cooperatives and similar forms of enterprise in Preston and the surrounding areas. PCDN is a member of Boost & Co, which includes additional public and private sector organisations that can help businesses grow.

John Atherton is a seasoned cooperative business consultant. After working 15 years at Co-operatives UK the national infrastructure organisation, he is currently working with Preston Co-op Development Network. John’s expertise lies in start-ups or conversion to worker co-ops, team dynamics and strategy formation in low hierarchy cultures. Formed in 2017 Preston Cooperative Development (PCDN) promotes and supports the development of cooperatives and similar forms of enterprise in Preston and the surrounding areas. PCDN is a member of Boost & Co, which includes additional public and private sector organisations that can help businesses grow.

Boost is helping Lancashire businesses. We have a range of funded support programmes and a team of business advisers you can talk to. To speak to someone from the Growth Hub about business support, contact Boost online or call 0800 488 0057.

The website uses cookies.

Some are used for statistical purposes and others are set up by third party services. By clicking 'Accept all & close', you accept the use of cookies. For more information on how we use and manage cookies, please read our Cookie Policy.